As important as the other core business functions of your business, payroll affects every aspect of a business - from employees’ morale to your company’s financial stability.

Whether you are starting a small entity with a few employees or running an established business, payroll management remains one of the critical business functions. Payroll basics, with the requisite tax and statutory deductions, and the laws that regulate payroll are all fundamental to your payroll. Timeliness, accuracy and compliance are key to the success of the payroll function.

As businesses today are getting busier than before, outsourcing your payroll may help you to free up your time to run and grow your business, and to avoid unwanted challenges with authorities and unhappy employees.

What is Payroll Outsourcing?

Outsourcing is a business practice of contracting a third-party professional service provider to perform certain services that are traditionally performed in-house by a company’s own employees.

Payroll outsourcing involves engaging an external payroll service provider to handle company payroll’s end-to-end administration and compliance functions.

How does outsourcing payroll help your business?

While companies primarily outsource to manage cost, today, it is about optimising the benefits of strategic outsourcing. These benefits include leveraging external expertise, relying on local specialists for payroll regulatory compliance, increasing accuracy, reducing overhead and turnaround time, arranging flexible staffing arrangements, increasing work efficiency and ultimately generating more profit.

For many small to medium-size businesses, payroll outsourcing has proven to be effective, efficient and beneficial. End-to-end outsourced payroll services can help you save time, reduce compliance risks, and ensure your employees are paid accurately and on time. With all these areas well taken care of, you will be able to focus on moving your business forward.

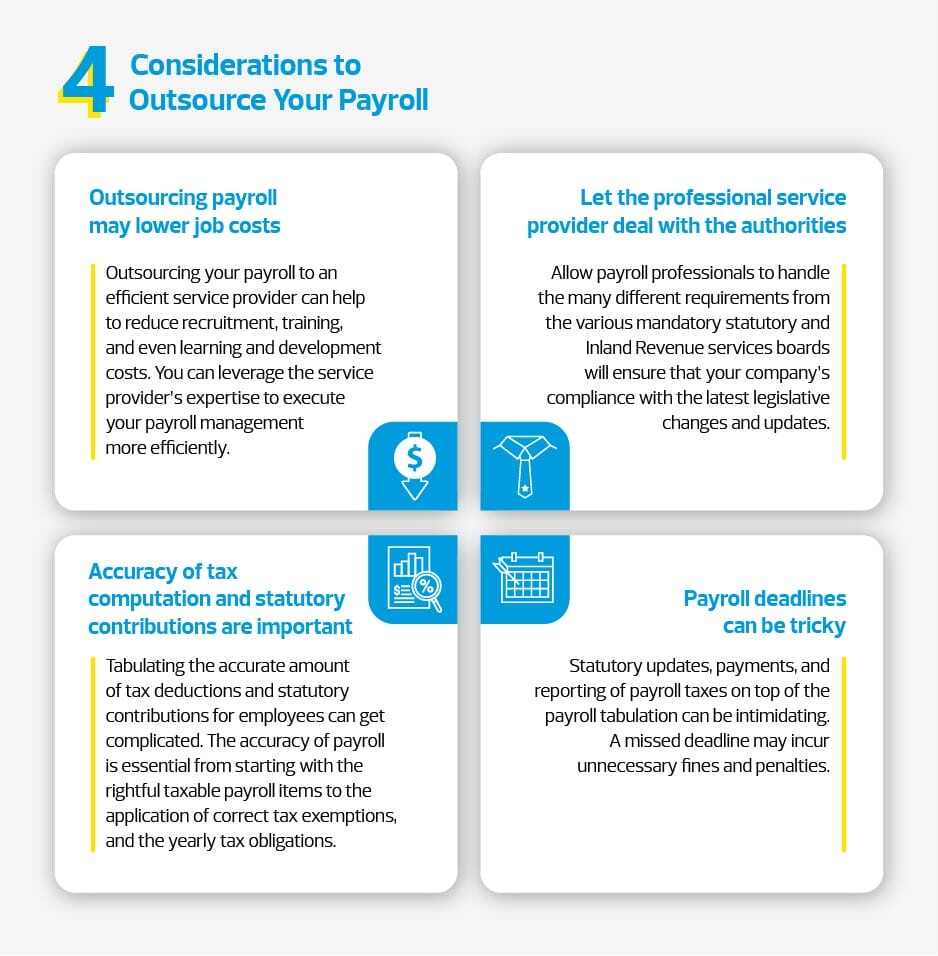

4 Considerations to outsource your payroll

1. Outsourcing payroll can lower job costs

Outsourcing your payroll to an efficient service provider can help to reduce recruitment, training, and even learning and development costs. You can leverage the service provider’s expertise to execute your payroll management more efficiently.

2. Let the professional service provider deal with the authorities

Allow payroll professionals to handle the many different requirements from the various mandatory statutory and Inland Revenue services boards will ensure that your company’s compliance with the latest legislative changes and updates.

3. Accuracy of tax computation and statutory contributions are important

Tabulating the accurate amount of tax deductions and statutory contributions for employees can get complicated. The accuracy of payroll is essential from starting with the rightful taxable payroll items to the application of correct tax exemptions, and the yearly tax obligations.

4. Payroll deadlines can be tricky

Statutory updates, payments, and reporting of payroll taxes on top of the payroll tabulation can be intimidating. A missed deadline may incur unnecessary fines and penalties.

Interested to outsource your payroll? Check out our services and enquire now.