Launched in 2021 by the Singapore Economic Development Board (EDB), the Tech.Pass aims to attract founders, leaders and technical experts with experience in established or fast-growing tech companies.

It is an extension of the Tech@SG programme, as part of Singapore’s efforts to attract tech talent to Singapore and develop Singapore’s tech ecosystem.

Holders of the Tech.Pass are able to concurrently;

- Start and operate a business.

- Be an employee in multiple Singapore-based companies.

- Take up lecturing roles in institutes of higher learning.

- Serve on the Board of Directors of a Singapore-based company.

- Be a shareholder or investor in Singapore companies.

- Serve as a mentor or advisor of start-ups or companies in Singapore.

- Their dependants would also be able to stay in Singapore on either a Dependant’s Pass (DP) or a Long-Term Visit Pass (LTVP) issued by MOM.

ELIGIBILITY CRITERIA

To be eligible, applicants must meet any two of the following three conditions:

- Earned a minimum fixed monthly salary of S$20,000 in the previous year;

- Have at least five cumulative years of experience in a leading role in a tech company with a valuation/market cap of at least US$500 million or at least US$30 million funding raised AND/OR;

- Have at least five cumulative years of experience in a leading role in the development of a tech product that has a minimum of 100,000 monthly active users or at least US$100 million in annual revenue.

For the last condition, a leading role can be defined as - having made major contributions to the design, development, and/or deployment of a tech product.

Individuals do not need to secure a sponsorship from a Singapore employer prior to their application for the Tech.Pass. They will instead be assessed based on their track record and prior experience in leading teams or developing tech products.

Additionally, existing EP, PEP, or EntrePass holders who meet the Tech.Pass criteria may apply for the same if they meet the prevailing eligibility or renewal criteria of their respective work passes, and if they require the flexible advantages provided by the Tech.Pass. If their existing pass is sufficient for the activities they undertake in Singapore, there is no need to convert to the Tech.Pass.

| What does the pass do? |

Eligibility |

Pass Validity |

Eligibility to bring in dependants |

|

Allows holders to concurrently:

- Start and operate multiple tech companies;

- Be employed by multiple Singapore-based companies at any one time.

|

Meet at least 2 of 3 criteria:

- Earn a monthly salary of S$20,000 and above;

- At least 5 years of leadership experience in a tech company;

- At least 5 years of leadership experience in development of a tech product.

|

- First-time applications: 2 years

- Thereafter renewals: 2 years upon meeting renewal criteria

|

Eligible to bring in dependants |

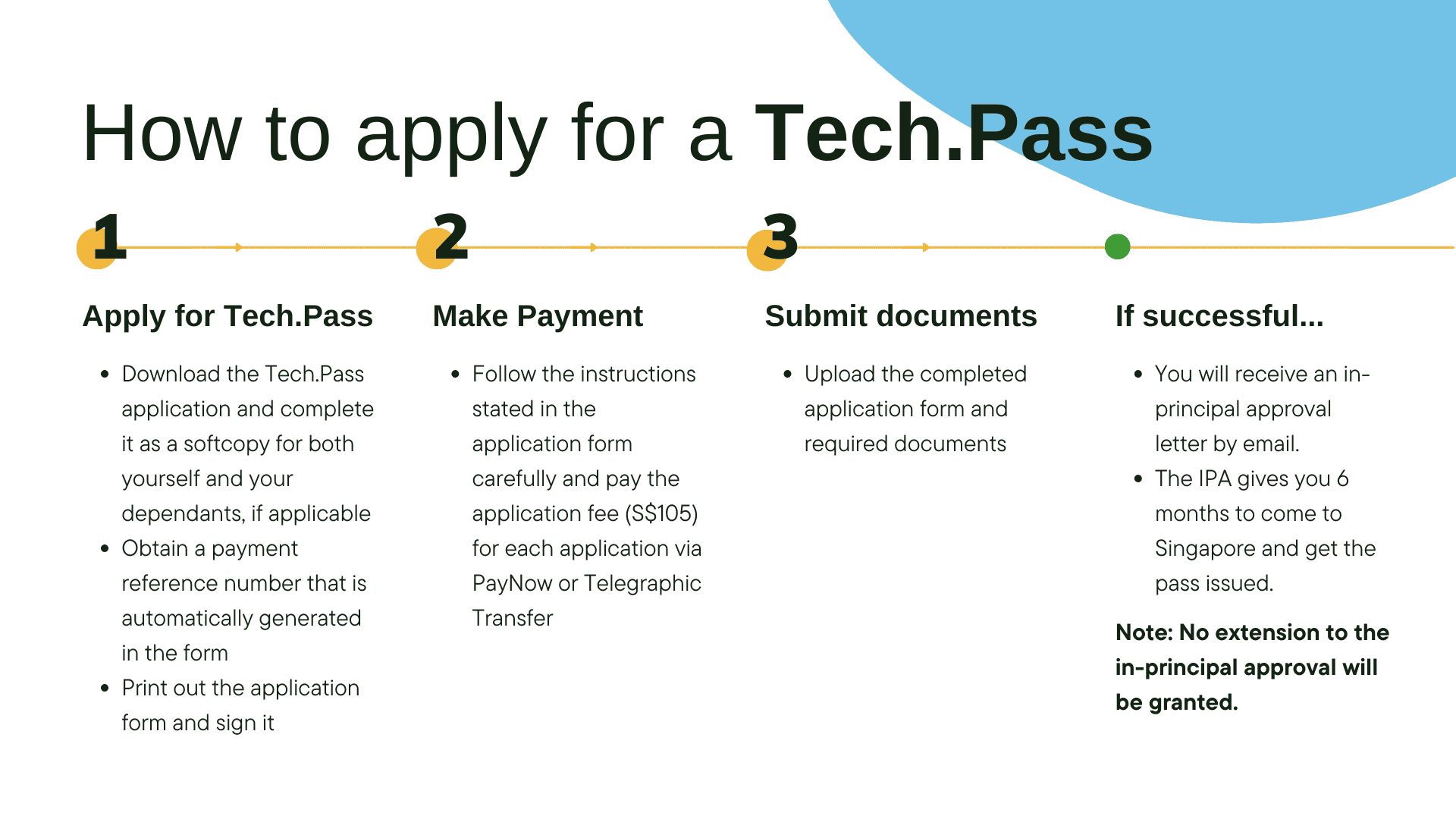

HOW TO APPLY

Once prospective applicants have ensured that they meet the eligibility criteria and have all the relevant supportive documents required, they may proceed to apply for the Tech.Pass.

1. Apply for Tech.Pass

- Download the Tech.Pass application here and complete it in a softcopy format for both the applicant and their dependants, if applicable.

- Obtain a payment reference number that is automatically generated in the form.

- Print out the application form and sign it.

- Prepare relevant supporting documents indicated in the application form.

2. Payment

- Follow the instructions stated in the application form carefully and pay the application fee (S$105) for each application via PayNow or Telegraphic Transfer.

3. Upload the completed application form and required documents here.

- Ensure that all of the following documents are submitted:

- Original completed and signed application form.

- Proof of payment receipt and travel document page.

- Supporting documents.

- [For dependants] Documents confirming the applicant’s relationship with the DP/LTVP applicant (e.g. marriage certificate, etc.) and the DP/LTVP applicant’s Verification of Vaccination Requirements issued by the Health Promotion Board (HPB), if required.

The processing period for Tech.Pass applications is around 8 weeks, and may be extended if additional information is required.

Successful applicants will receive an in-principal approval (IPA) letter by email. The IPA grants successful applicants 6 months to come to Singapore and get the Tech.Pass issued in order to start work or business activities in Singapore. They must be in Singapore to have the pass issued.

The issuance of the Tech.Pass can be done via MOM's EP Online System (if the applicant has a SingPass), or in person at the MOM Employment Pass Services Centre with an appointment.

Fees involved:

- S$225 for each pass.

- S$30 for each Multiple Journey Visa, if applicable.

Do note that no extension to the IPA will be granted.

CRITERIA FOR RENEWAL

The Tech.Pass may be renewed for another two years. To be eligible for a two-year renewal, the pass holder must:

- Have earned at least S$240,000 in assessable income based on the latest Notice of Assessment from the Inland Revenue Authority of Singapore (can be made up of salaries and / or business income); OR

- Demonstrate a total annual business spending of at least S$100,000 and employ at least one local PME or three LQS.

- Local PMEs refer to professionals, managers, and executives who are Singaporeans or Singapore Permanent Residents, earn a fixed monthly salary of at least S$3,900 and receive CPF contributions for at least 3 months.

- LQS refers to Singaporeans and Singapore Permanent Residents who earn a monthly salary of at least S$1,400 and receive CPF contributions for at least 3 months.

- Perform at least two of the following roles, at least one of which must be in Column (A):

| A |

B |

- Founded a company in Singapore, offering a tech-based or tech-enabled product or service

- Served a leading role (e.g. CEO, CTO, APAC MD) in a Singapore-based tech company

- Served a leading role in two or more Singapore-based tech companies

- Employed a technical role leading a team in a Singapore-based company e.g. a senior engineer or senior researcher leading a team in a particular tech field

- Employed a technical role leading a team in two or more Singapore-based companies

|

- Served on Board of Directors of a Singapore- based company

- Need not be a tech company

- Acted as advisor or mentor to a Singapore- based start-up

- Served as professor/ lecturer/ adjunct professor/ adjunct lecturer in a Singapore Institute of Higher Learning (IHL)

- Provided training in some form not covered by B2 or B3

- Invested in one or more Singapore-based tech companies

|

NEED HELP?

PayrollServe offers a wide variety of payroll, HR services – including tax filing, HR compliance review as well as Work Pass management – and systems specially catered to your unique needs. By outsourcing your payroll and HR administration to PayrollServe, your HR team will be able to focus on improving rather than managing existing business operations with our support.

Contact us to learn more about how PayrollServe can help your business.

Additional resources: